A Competitive Analysis Model

Overview

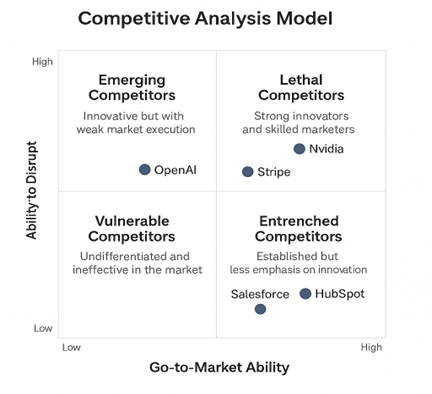

Many organizations conduct competitive assessments without a structured framework, often relying on incomplete SWOT analyses or narrow product comparisons. This Competitive Analysis Model offers a standardized approach to evaluating competitors based on their ability to innovate disruptively and their effectiveness in bringing products to market.

The Need for a Framework

Imagine how a tech company evaluates potential acquisition targets. It doesn’t just look at revenue—it assesses intellectual property, product roadmap, customer base, leadership quality, and market momentum. The consistent use of these criteria allows decision-makers to compare multiple companies fairly. Similarly, this Competitive Analysis Model gives organizations a balanced, comprehensive view of their competitors using consistent dimensions that reveal both current standing and future potential.

Model Dimensions

This model evaluates competitors along two critical axes:

1. Ability to Disrupt

This dimension captures a company’s potential to introduce game-changing products, services, or business models that significantly alter market dynamics. It considers innovation, speed to market, and technical leadership.

High scores indicate:

● Visionary leadership and deep domain expertise

● Clear product vision with rapid iteration cycles

● Bold innovation and market-first strategies

● First-mover advantage in new segments

● Acquisitions that accelerate innovation or expand capabilities

● Access to capital and investment in R&D and emerging technology (e.g., AI, blockchain)

● Responsiveness to changing market conditions

● Patent portfolios or proprietary technology

● Strong partner ecosystems

Examples of high disruptive ability:

● Nvidia is developing AI-optimized GPUs before the AI explosion, enabling massive growth and industry dominance.

● OpenAI is launching GPT-based APIs, which have rapidly become integral to productivity and software tools, disrupting how software is built and consumed.

● Stripe is introducing a developer-first payments API that dramatically simplifies payment integrations, displacing older legacy systems.

Examples of low disruptive ability:

● A legacy software vendor is slowly adapting to cloud infrastructure while relying heavily on on-premise licensing models.

● A mobile hardware manufacturer releases incremental updates without innovation while competitors explore foldables, AR integration, or AI features.

2. Go-to-Market Ability

This dimension reflects how well a company can translate its offerings into market success through sales, marketing, distribution, and customer adoption strategies. Indicators include:

● Deep understanding of buyer personas and use cases

● Buyer-focused marketing strategies

● Experienced marketing and sales leadership, scalable sales infrastructure, and partner networks

● Established and scalable customer access

● Growing market share and revenue

● Effective brand messaging, high awareness, and customer loyalty

● Reputation for market excellence

● Strong customer onboarding, retention, and expansion programs

Examples of high go-to-market ability:

● Salesforce leveraging its enterprise salesforce and brand to rapidly introduce new clouds (e.g., Marketing Cloud, Health Cloud) across verticals.

● HubSpot using inbound marketing and self-service onboarding to dominate the SMB CRM space.

● Zoom capitalizing on viral adoption and channel partnerships during the pandemic, expanding from education into enterprise communication.

Examples of low go-to-market ability:

● A startup with brilliant technology but no clear ICP (ideal customer profile), struggling to generate leads or close deals.

● A firm relying on a single distribution channel that no longer reaches their target buyers (e.g., physical retail for SaaS products).

Competitor Quadrants

Based on their scores across both axes, competitors fall into one of four quadrants:

Vulnerable Competitors

These organizations lack innovation and effective market execution. They:

● Offer undifferentiated products

● Compete primarily on price or through negative tactics

● Use outdated or inefficient marketing and sales methods

● They are easily displaced when switching costs are low

Emerging Competitors

Strong in innovation but weak in market execution. These companies:

● Attract early adopters

● Rapidly release new or improved products

● Lack of established sales and marketing infrastructure

● Represent potential future threats as they scale

Entrenched Competitors

Strong market players with less emphasis on innovation. Typically, they:

● Have wide market reach and brand awareness

● Maintain customer loyalty and visibility

● Excel in sales operations and customer engagement

● Rely more on existing offerings than breakthrough innovation

Lethal Competitors

These companies are strong innovators and skilled marketers. They:

● Set high barriers for competitors through differentiation

● Lead in both product development and customer acquisition

● Attract early adopters and mainstream buyers alike

● Possess the resources and talent to scale effectively

Example

Strategic Application

This Competitive Analysis Model supports strategic decision-making by offering a clear view of the threat landscape in any market segment. It enables organizations to:

● Prioritize competitors by potential impact

● Tailor defensive and offensive strategies

● Align internal resources to address real threats and opportunities

● Selecting target market segments

● Identifying and evaluating key competitors

● Applying the model insights to competitive planning and strategic initiatives

By Chip Correra, Partner